Growth in a Crisis (Xiong Hou)

In the first half of 2010, the Greek sovereign debt crisis hit Europe severely, casting a shadow over the region's slow economic recovery. Although the crisis has been gradually curbed across Europe, thanks largely to major financial stability measures by the EU and its member states, it still poses grave challenges to the long-term economic growth of Europe. Faced with serious structural problems brought to light by the crisis, Europe must carry out substantial measures to regain vitality and ensure lasting growth.

Gradual recovery

| |

| CRISIS IN GREECE: Protestors gather in front of the parliament in Athens on June 29. The protest was part of a general strike against austerity measures (XINHUA/AFP) |

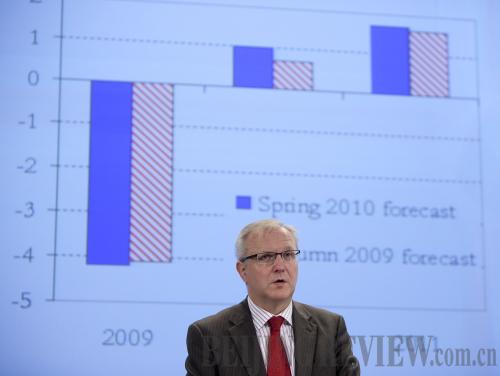

So far, the Greek sovereign debt crisis has never halted the recovery trend of the European economy, which started a slow recovery before the outbreak of the debt crisis. This was confirmed by the European Economic Forecast Spring 2010, issued on May 5. After negative growth of as much as 4 percent in 2009, it was predicted that the EU would embrace growth rates of 1 percent and 1.75 percent in 2010 and 2011, respectively, both being 0.25 percentage points higher than the prediction of the European Economic Forecast Autumn 2009.

In their economic forecast report, the Organization for Economic Cooperation and Development (OECD) and the IMF also said the European economy had started recovery.

Statistics released by Eurostat, the EU statistics agency, on August 13, say in the second quarter of this year, the EU economy grew by 1 percent compared to the first quarter and 1.7 percent compared to the same time last year. This performance was much better than that of the first quarter of this year. The 1-percent quarter-on-quarter growth rate even surpassed that of the United States.

Despite the notable improvement, the European economy remains fragile and its growth rate is quite low. Further, EU member states differ greatly in their economic growth. Of all the member states, Germany enjoyed an excellent economic performance, with a quarter-on-quarter growth rate of 2.2 percent and a year-on-year growth rate of 3.7 percent. But the Greek economy shrank by 1.5 percent in the second quarter of this year, compared to the first quarter. Spain and Portugal each saw a quarter-on-quarter growth rate of 0.2 percent. (See p.12)

These different recovery conditions reveal differences in economic development and policy implementation. They also show that some member states may still be prone to another economic crisis.

Currently, there is still high uncertainty with regard to the future of the European economy. Fortunately, the risk of economic recession has been generally brought within control. The successful implementation of the Greek bailout package and the establishment of a reliable fiscal consolidation system will help strengthen investors' confidence. And the global trade recovery, driven by the strong demand of emerging countries, will greatly promote the export-oriented German economy and thus help the economic growth of the EU.

Haunting risks

At the beginning of the Greek sovereign debt crisis, people were concerned it would impact the stability of the financial market and lead to a new round of financial crisis. In July 2010, the EU carried out a stress test on banks in the euro zone. The test confirmed the banks were sound, while showing the potential risk of the European banking sector was far below market expectation.

Only seven of the 91 banks participating in the stress test failed, with a combined capital shortfall of 3.5 billion euros ($4.4 billion). This accounted for just 0.02 percent of the total assets of the banks in the test. Due to the capital shortfall, the seven banks had insufficient reserves to maintain a Tier 1 capital ratio of at least 6 percent, in the event of a recession and sovereign-debt crisis. Under unfavorable conditions, the 91 banks will suffer a total loss of 566 billion euros ($716 billion) in 2010, accounting for only 2.5 percent of the total assets of the banks in test.

However, the stress test was not widely accepted. Some people doubted its credibility. For instance, it did not take into account the default risk of government bonds. It also underestimated the high financing costs given the liquidity shortages today, while neglecting risk transmission between banks and between countries. In this sense, the unfavorable impacts of the sovereign debt crisis on the European banking sector may last for a long time.

Europe may find it difficult to reduce public debt dramatically in the foreseeable future. The IMF predicts, until 2013, the ratio of public debt to GDP will continue to rise in developed economies including those in Europe. Europe's fiscal consolidation measures can slow this trend, but cannot stop it.

The expansion of public debt may raise the long-term interest rate. And an interest rate hike will make the repayment of public debt more difficult. This forms a vicious circle that will bring destructive effects to the real economy and the financial system.

| |

| GOOD NEWS: European Commissioner for Economic and Monetary Affairs Olli Rehn presents the spring forecast for the European economy at a press conference in Brussels on May 5. The forecast said the EU economy would grow by 1 percent in 2010, 0.25 percentage points higher than the prediction in autumn last year (XINHUA) |

What's more, a high long-term interest rate will increase financing costs, and thus harm the banking sector.

In addition, banks will probably be exposed to systemic risks resulting from a high long-term interest rate. On the one hand, fiscal austerity will negatively influence economic growth. A real economy with a poor performance will impose a bigger credit risk on banks. On the other hand, a high interest rate raises investment costs and restrains private investment, which is bad news for bank lending.

Policy coordination

The Greek sovereign debt crisis left two lessons for Europe. One is that there are severe structural problems with the European economy. The other is that Europe's economic and fiscal policy coordination has serious shortcomings. Inside a highly integrated economy, a lack of coordination will only aggravate problems. In order to tackle the crisis and prevent unfavorable situations in the future, Europe needs to establish a sound coordination system.

Reforms are necessary to resolve the structural defects of the European economy. The current problems will not automatically disappear after economic recovery, as they emerged as long-term defects in the past decade, when economic growth was robust.

Problems in labor, product structure and service markets, as well as in the financial sector are the major reasons for the EU member states' current account differences. Economic disparities among eurozone member states have existed since the introduction of the euro. Internal imbalances in the euro zone are a reflection of the differences in the member states' economic structure.

Europe needs to solve its problems through coordination. First of all, it should strengthen the corrective and preventive role of the Stability and Growth Pact. All EU member states should implement fiscal management systems in line with the pact. This is good for strengthening fiscal discipline in the long term. In addition, finance ministers should strengthen the sense of responsibility and independence. This can be realized through submitting stability plans to the member states' parliaments.

Second, Europe should deepen its economic policy coordination. A mere reliance on fiscal policy cannot solve the underlying problems of the euro zone. The recently established eurozone countries' competitiveness surveillance system is an example of strengthened coordination.

Third, it is essential to establish a full-fledged crisis resolution mechanism. Emergency assistance should be provided only under certain financial and economic conditions. While the aid for Greece was indispensible, the EU member states and the IMF also imposed strict conditions on the loans to Greece. These conditions were set under the crisis resolution mechanism.

The author is a researcher with the Institute of European Studies of the Chinese Academy of Social Sciences

http://www.bjreview.com.cn/quotes/txt/2010-08/31/content_295060_2.htm

- Back _articles: New China-Europe era (Jiang Shixue)

- Next _articles: Symmetry and Asymmetry in China-EU Partnerships (Zhou Hong)